tucson sales tax calculator

Then use this number in the multiplication process. Vehicle Use Tax Calculator Buyers Address Vehicle Domicile Address Street Address Zip Code Vehicle purchased out of country.

Rate And Code Updates Arizona Department Of Revenue

The December 2020 total local sales tax rate was also 8700.

. Sales tax in Tucson Arizona is currently 86. The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. The average sales tax rate in Arizona is 7695.

21120 for a 20000 purchase Fort Mohave AZ 56 sales tax in Mohave County You can use our Arizona sales tax calculator to determine the applicable sales tax for any location in Arizona by entering the zip code in which the purchase takes place. Find list price and tax percentage. Tucson AZ Sales Tax Rate Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700.

Multiply the price of your item or service by the tax rate. If this rate has been updated locally please contact us and we will update the sales tax rate for Tucson Arizona. The Arizona sales tax rate is currently 56.

Tucson is in the following zip codes. Method to calculate New Tucson sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Spring Valley AZ Sales Tax Rate.

Taxable Sales Amount Vehicle Price Price of Accessories Additions Trade-In Value Manufacturer Rebate Tax Paid Out of State Dealers Zip Code Fields marked with are required. The average sales tax rate in Arizona is 7695 The Sales tax rates may differ depending on the type of purchase. Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality.

United States Tax ID Number Business License Online Application. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Simply Bookkeeping Taxes Taxes-Consultants RepresentativesTax Return PreparationAccounting Services WebsiteDirectionsMore Info 4 YEARS IN BUSINESS 1 YEARS WITH 520 815-0083 2761 N Country Club Rd Ste 101 Tucson AZ 85716. The County sales tax rate is 0. The sales tax jurisdiction name is Arizona which may refer to a local government division.

These rates were entered mostly from tables published by the ADOR that were effective as of August 1 2015. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

The December 2020 total local sales tax rate was also 11100. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. This is an Arizona sales tax calculator designed to meet the specific needs of the construction industry.

South Tucson AZ Sales Tax Rate The current total local sales tax rate in South Tucson AZ is 11100. Wayfair Inc affect Arizona. Ad Lookup Sales Tax Rates For Free.

Sales Tax Breakdown South Tucson Details South Tucson AZ is in Pima County. 22 lower than the maximum sales tax in AZ The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Stanfield AZ Sales Tax Rate. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax Comparison Calculator for 202223.

Free sales tax calculator tool to estimate total amounts. Springerville AZ Sales Tax Rate. The default sales tax rates are provided for your convienience.

Did South Dakota v. How to Calculate Sales Tax. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

Tucson Code Section 19-1301 is repealed effective January 01 2015. South Tucson AZ Sales Tax Rate. Tax Return PreparationTax Return Preparation-BusinessInsurance 520 268-8508 2325 E Miraval Primero Tucson AZ 85718 2.

The Tucson sales tax rate is 26. 801 Average Sales Tax Summary. This is the total of state county and city sales tax rates.

Usually it includes rentals lodging consumer purchases sales etc For more information please have a look at Arizonas Official Site. The Tucson Sales Tax is collected by the merchant on. This will give you the sales tax you should expect to pay.

Ordinance 11904 was passed by the Mayor and Council on May 25 2022 amending the City Tax Code by extending the additional five-tenths of one percent 05 tax rate increase on certain business classifications for an additional ten-year period through June 30 2032. Az Sales Tax - Prime Contracting - Class 015. Youll then get results that can help provide you a better idea of what to expect.

There is no applicable special tax. Tucson Sales Tax Rates for 2022. Tax rates can be.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Divide tax percentage by 100 to get tax rate as a decimal. You can print a 87 sales tax table here.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Before-tax price sale tax rate and final or after-tax price.

Interactive Tax Map Unlimited Use. For example if your budget for your next car is 15000 and you make your purchase in Apache County you would pay about 915 in sales tax 15000 x 061. Sales Tax Breakdown Tucson Details Tucson AZ is in Pima County.

The South Tucson Sales Tax is collected by the merchant on all qualifying sales made within South Tucson. 85701 85702 85703. Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Tucson Arizona.

How To Use A California Car Sales Tax Calculator

How To Calculate Sales Tax On Calculator Easy Way Youtube

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Arizona Sales Tax Rates By City County 2022

Property Taxes In Arizona Lexology

Property Tax Calculator Casaplorer

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

2021 Arizona Car Sales Tax Calculator Valley Chevy

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 15 Free To Download And Print Sales Tax Calculator Tax

Arizona Income Tax Calculator Smartasset

How To Charge Sales Tax Vat With Samcart Samcart

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Arizona Sales Tax Small Business Guide Truic

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Arizona Income Tax Calculator Smartasset

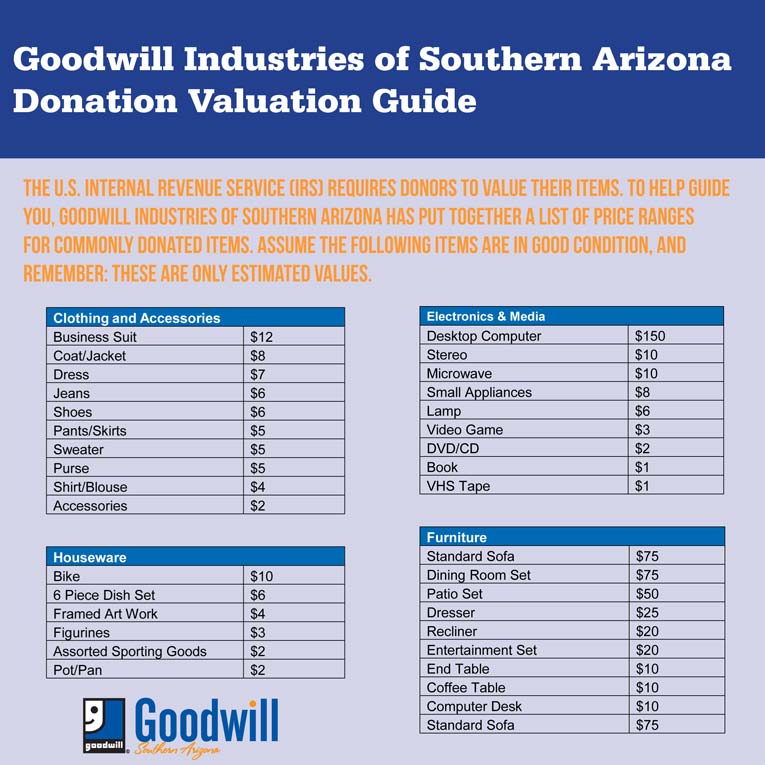

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona